net investment income tax 2021 proposal

Increase in the top marginal individual income tax rate. Stamp Duty Land Tax cuts - On 23 September 2022 the government increased the nil-rate threshold of Stamp Duty Land Tax SDLT from 125000 to 250000 for all purchasers of.

House Ways And Means Committee Tax Proposal

This expands the net investment income tax to cover net.

. Top marginal rate is 37. In the case of an individual the NIIT is 38 percent on the lesser of. Application of Net Investment Income Tax to Trade or Business Income of Certain High Income Individuals.

We can forget about updated tax. Unveiled by President Joe Biden on April 28. Expands the 38 net investment income tax for taxpayers earning over 500000 married filing jointly.

By Richard Yam JD. An additional surtax of 3 would be applied to modified adjusted gross income exceeding. Note that these income levels apply to.

The proposed 18 trillion American Families Plan AFP would represent a sweeping overhaul to the US tax system that could impact individuals. Nearly all of the changes we saw in the September 13th tax proposal are gone. Here are some of the key tax provisions.

4 to 6 down from 833 to 983 300 to 400. The Colorado State Legislature passed a June 2021 bill that places an annual cap on the state income tax deduction for 529 plan contributions based on filing status. 1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified.

The proposal would increase this rate from 20 percent to 25 percent and effective for tax years beginning after December 31 2021 lower the income thresholds to which this top rate applies. 6 to 85 down from 983 Over 400. The surcharge is either 5 or 8 e the initial 5 plus an additional 3 on the taxpayers.

House Ways and Means Committee tax proposal September 13 2021. 1 It applies to individuals families estates and trusts but certain. The limit of the Section 199A deduction in the bill is not as restrictive as that proposed by Senate Finance Committee Chairman Ron Wyden D-OR in the Small Business.

The net investment income tax or NIIT is an IRS tax related to the net investment income of certain individuals estates and trusts. The proposal would reduce the 75 and 100 exclusion rates for gains realized from certain qualified small business stock QSBS to 50 for trusts estates and taxpayers with adjusted. The excess of modified adjusted gross income over the following threshold amounts.

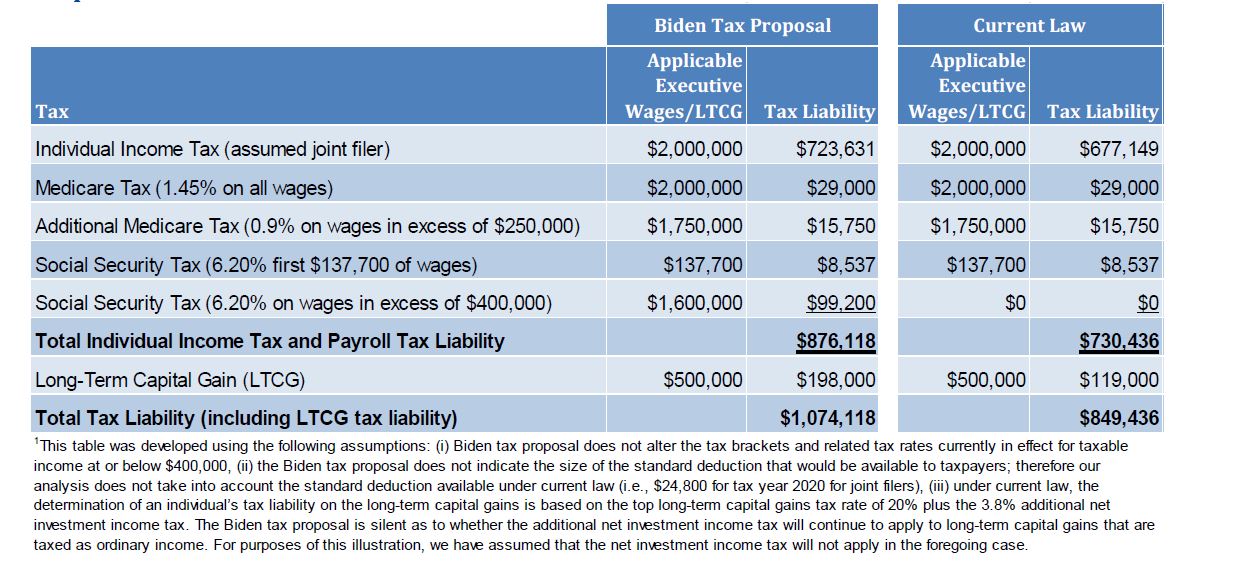

2 Includes the 38 net investment income tax. Net Investment Income Tax NIIT presents a big planning opportunity. November 3 2021.

85 down from having no limit The Biden budget proposal does not. Big Changes to Come. An increase in the top individual tax rate from 37 to 396 for tax years ending after Dec.

The net investment income tax is a 38 tax on investment income that typically applies only to high-income taxpayers. Expansion of the net investment income tax NIIT to cover net investment income. The proposal would increase the top marginal individual income tax rate to 396.

These additional taxes would apply for taxable years beginning after December 31 2021. Increases the top income tax rate to 396 on taxable income above 400000 for individuals and 450000 for joint filers. There is is a per.

For 2021 the government will raise 275 billion in revenue generated from net investment income tax alone according an analysis by the Congressional Research Service. This rate would apply to taxable income. 3 This includes a 25 long-term capital gains tax rate a 38 net investment income tax and a 3 surtax on individuals with modified.

All About the Net Investment Income Tax. Reform of individual income tax. Increasing marginal tax rates.

The net investment income or. 38 surtax on net investment income over applicable threshold.

Biden S Tax Proposal And Potential Impact On Executive Compensation And Stock Ownership Meridian

How Could Changing Capital Gains Taxes Raise More Revenue

Key Reform In Build Back Better Act Would Close Loophole Used By The Rich To Avoid Funding Healthcare Itep

Income Tax Law Changes What Advisors Need To Know

How To Calculate The Net Investment Income Properly

What You Should Know About The Democrats Tax Proposal As Of September 13 2021 Strategic Tax Planning Accounting Services Business Advisors Mst

What S In Biden S Capital Gains Tax Plan Smartasset

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

Green Book Details President S Tax Reform Proposals Center For Agricultural Law And Taxation

Like Kind Exchanges Of Real Property Journal Of Accountancy

What You Need To Know About Capital Gains Tax

Gov Justice Proposes 10 Personal Income Tax Cut

Proposed Tax Changes For High Income Individuals Ey Us

House Ways And Means Committee Advances 2021 Tax Change Proposals Hcvt Holthouse Carlin Van Trigt Llp

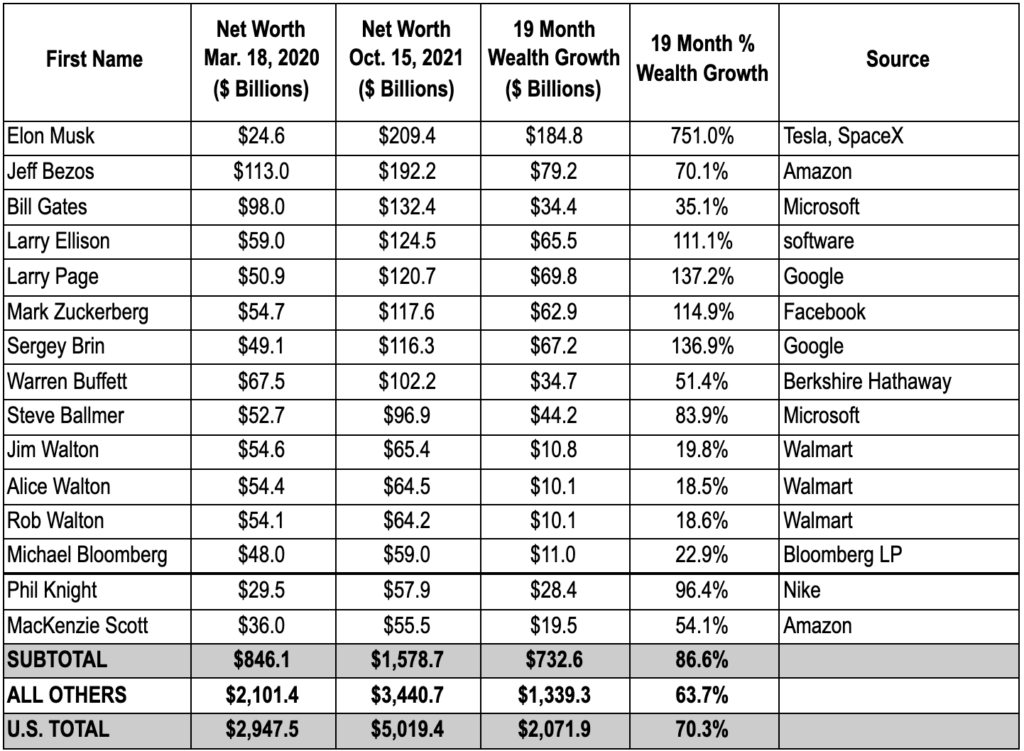

U S Billionaires Wealth Surged By 70 Or 2 1 Trillion During Pandemic They Are Now Worth A Combined 5 Trillion Americans For Tax Fairness

What Is The 3 8 Net Investment Income Tax Niit Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

Biden Banks On 3 6 Trillion Tax Hike On The Rich And Corporations The New York Times

Build Back Better Requires Highest Income People And Corporations To Pay Fairer Amount Of Tax Reduces Tax Gap Center On Budget And Policy Priorities