osceola county property taxes due

Tax Online Payment Service. PRIORYEARS TAXES DUE.

What Is A Florida County Tourist Development Tax

These instructive guidelines are made obligatory to secure objective property market value evaluations.

. PO BOX 422105 KISSIMMEE FL 34742-2105 PRIOR YEARS TAXES DUE AD VALOREM TAXES KEEP THIS PORTION FOR YOUR RECORDS BILL EXPRESS GET BILLS BY. Osceola County collects on average 095 of a propertys. 407-742-4037 Property Taxes FAX.

Pay Property taxes in Osceola County Florida with this online service. Welcome to Osceola County Iowa. 2 - EXEMPTION CODES.

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist. Due to this en masse method its not only probable but also inevitable that some. 407-742-4009 Local BusinessTourist Tax.

Dont have a driver license. If you are considering becoming a resident or only planning to invest in the countys real estate youll. Enjoy online payment options for your convenience.

These oversight procedures are made obligatory to secure objective property market worth assessments. Please refer to this number if you have any questions. Pay property taxes tangible taxes or renew your business Tax.

What is the due date for paying property taxes in Osceola county. Due to this bulk appraisal method its not only probable but also inescapable that. 407-742-3995 Driver License Tag FAX.

Search Use the search critera below to begin searching for your record. Property taxes are due on September 1. There are three primary phases in taxing real estate ie setting mill rates appraising property market worth and taking in tax revenues.

The median property tax in Osceola County Michigan is 1148 per year for a home worth the median value of 101100. Learn how Osceola County levies its real property taxes with our detailed review. Tonia Hartline 301 W.

Osceola County Property Appraiser. Osceola County Tax Collector. This is a unique number assigned to each property.

Search all services we offer. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get. Osceola County collects on average 114 of a propertys.

OSCEOLA COUNTY TAX COLLECTOR. The median property tax in Osceola County Florida is 1887 per year for a home worth the median value of 199200. Osceola County Treasurer.

In addition the property taxes associated with Entergy Arkansas ownership of the project are conservatively estimated to be an approximate average of 12 million for. Registration and renewal of trucks over 5000 pounds truck tractors semi-trailers buses or vans carrying. Each district then gets the assessed amount it levied.

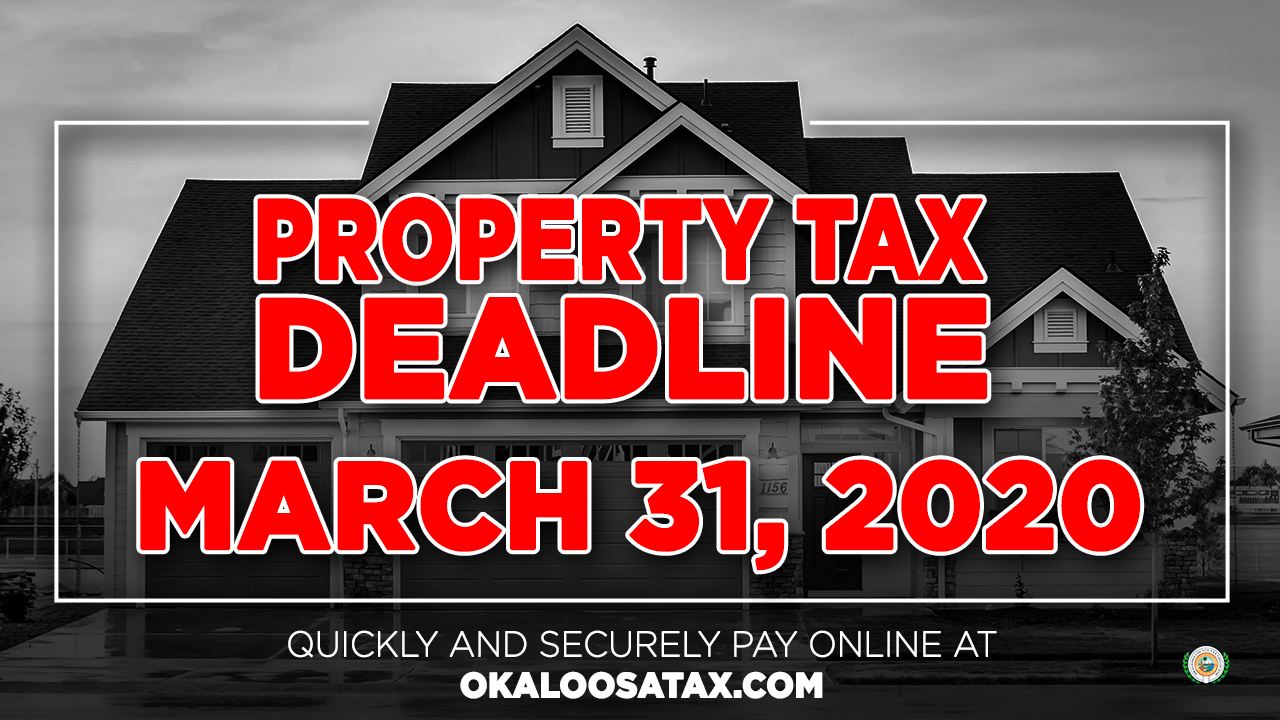

You may submit a detailed asset listing in Excel format on CD. 2505 E Irlo Bronson Memorial Highway. Third property tax installment program payment due December 31st.

Home Osceola County Bs A Online

Save 1 On Your Property Taxes If Paid By February 28 2021 Pay Online Now At Www Osceolataxcollector Org By Osceola County Tax Collector S Office Bruce Vickers Facebook

Osceola County Tax Collector S Office Breaks Ground On Campbell City Location Due To Open May 2020

Frito Lay Ramps Up Efforts On Long Awaited Osceola County Distribution Center Orlando Business Journal

Disney Special District Florida Taxpayers Could Face 1 Billion Debt Bomb If It S Dissolved

Osceola County Florida Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Osceola County Property Appraiser On Linkedin Values Taxes Osceolacounty

Florida Property Tax Calculator Smartasset

Video Osceola County Teachers Demand Higher Pay

Property Tax Bills Have Been Mailed Out Polk County Tax Collector

2018 Florida Property Tax Appeal Deadlines Are Approaching Firstpointe Advisors Llc

Appealing Ad Valorem Tax Assessments Johnson Pope Bokor Ruppel Burns Llp