rank real estate asset classes by risk

Managing Commercial Real Estate Concentrations. Mortgage- and asset-backed securities may be sensitive to changes in interest rates subject to early repayment risk and their value may fluctuate in response to the markets perception of issuer creditworthiness.

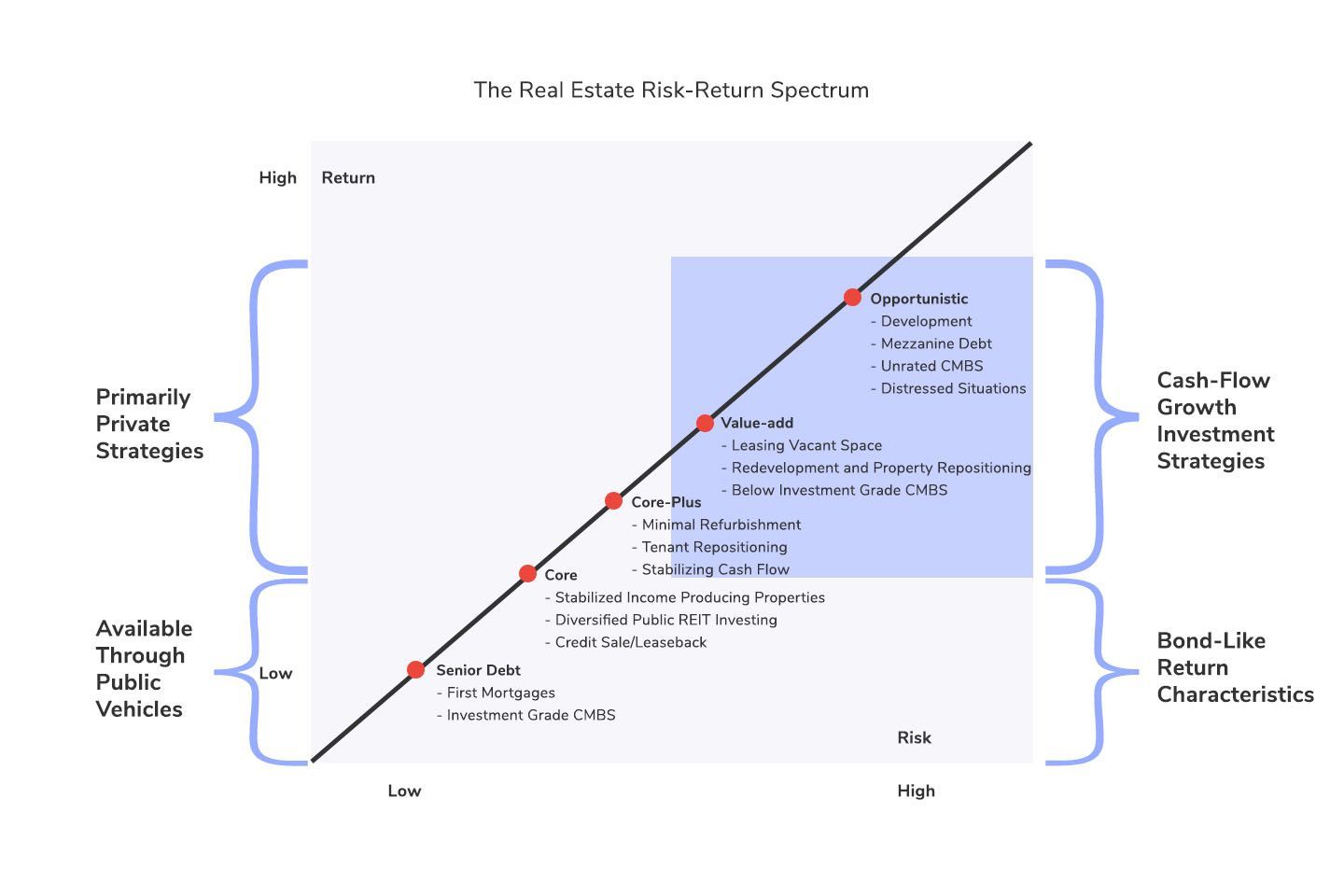

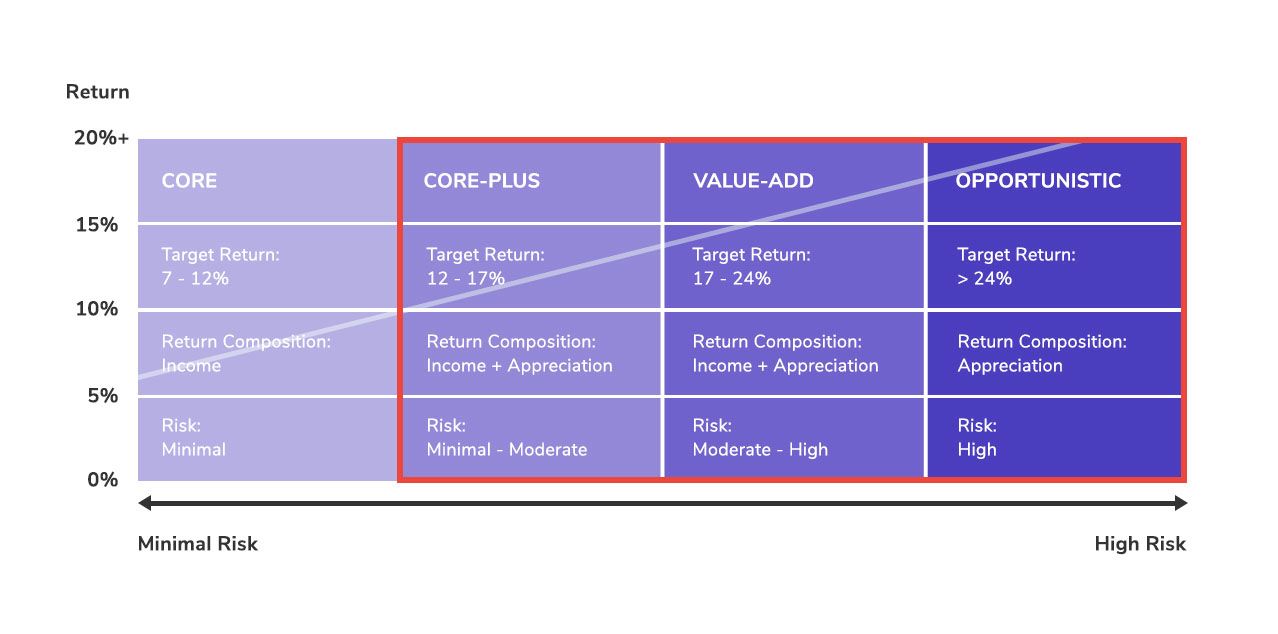

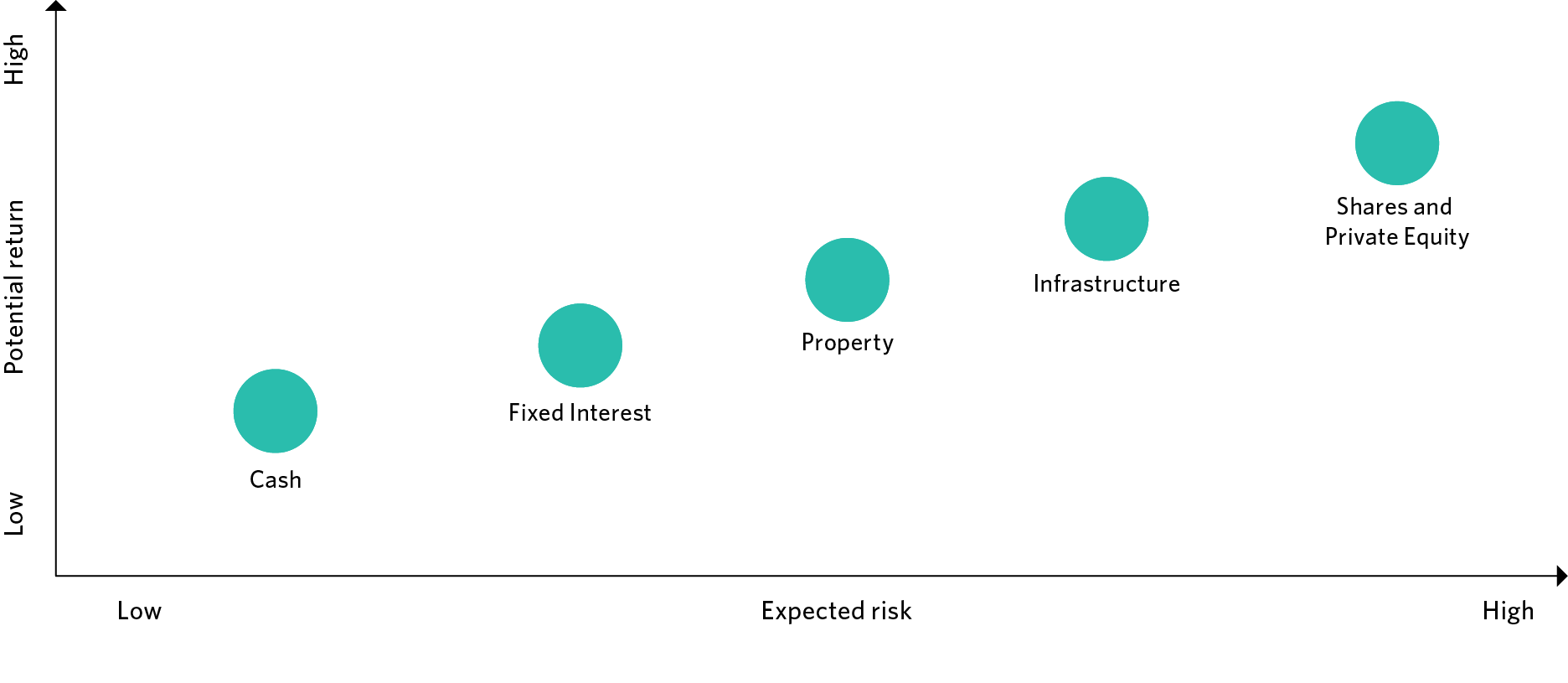

The Real Estate Risk Reward Spectrum Investment Strategies

Primary Asset Type.

. While generally supported by some form of government or private guarantee there is no assurance that private guarantors will. This real estate investment trust which focuses on the acquisition renovation up branding and. It also involves in in-house.

Realty Income Forbes Bio. In 1995 Steve was Vice President and Senior Asset Manager for Cornerstone Real Estate Advisers now Barings Inc a wholly-owned subsidiary of MassMutual Financial Group where he was responsible for over 13 million square feet of commercial property in the Southeastern US. Get latest NAV Returns SIP Returns Performance Ranks Dividends Portfolio CRISIL Rank Expert Recommendations and Comparison with gold stockULIP etc.

The MSCI ESG Fund Ratings are designed to offer investors greater insights into the ESG characteristics of funds and ETFs as well as provide additional information with respect to ESG fund research product selection portfolio construction and. Is a real estate company which engages in generating dependable monthly cash dividends from a consistent and predictable level of cash flow from operations. New York New York.

Joe has earned the coveted and highly respected rank of Eagle Scout. You can insure for many of the risks. Commercial real estate CRE loans comprise a major portion of many banks loan portfolios.

Multi-city deals occupied the top rank in institutional investment its share increasing to 36 in H1 2022 from 30 in H1 2021 while on individual cities basis NCR accounted for the maximum amount of real estate investment in H2 2022 attracting 21 share of the total investment. He brings the same level of determination resolve and integrity needed to become an Eagle Scout to his real estate. Valued in excess of 110 million.

Here are five stocks added to the Zacks Rank 1 Strong Buy List today. Lesser risk than most hybrid funds as the investments are spread across. Demand for CRE lendinga traditional core business for many community bankshas been very strong in recent years and a growing number of banks have CRE concentrations that are high by historical standards and.

Multi Asset Allocation Funds are hybrid funds that must invest a minimum of 10 in at least 3 asset classes. Currently paying a dividend of 118 per share the. Multi-Assets and all other asset classes are ranked based on their aggregate 3-month fund flows for all US-listed ETFs that are classified by ETF Database as being mostly exposed to those respective asset classes.

A native of the Main Line of Philadelphia Joe attended Cabrini College where he earned a Bachelor of Science degree in Business and a minor in Marketing. Advantages of Multi Asset Allocation Funds. History has proved that real estate is possibly the most forgiving asset over time.

In the first half of 2022 investments in real estate grew by 4 per cent Y-o-Y year-on-year to USD 34 billion. Not just building insurance but smart investors take out landlords insurance to protect their interests. If you are prepared to hold an investment property over a number of years it is bound to rise in value.

Magazine said more Real Estate Investment Trusts REITs would get listed on the stock exchanges to monetise rent-yielding office retail and warehousing assets. These funds typically have a combination of equity debt and one more asset class like gold real estate etc. Headquartered in Pasadena Alexandria Real Estate Equities ARE is a Finance stock that has seen a price change of -2876 so far this year.

3-month fund flows is a metric that can be used to gauge the perceived popularity amongst investors of Multi-Assets relative to other.

/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

How To Achieve Optimal Asset Allocation

The Real Estate Risk Reward Spectrum Investment Strategies

The Real Estate Risk Reward Spectrum Investment Strategies

Ubs These 12 Massive Housing Markets Are Too Hot Global Real Estate Marketing World Cities

Important Two Things You Must Consider Before Deciding On A Category Age Risk Appetite In General You Should Be More Risk Averse As You Have Time

What Is My Investment Risk Tolerance Peerfinance101 Investing Finance Investing Money Management Advice

Asset Allocation Planning Your Asset Allocation Between Large Cap Mid Cap Small Cap And Other Asset Clas Small Caps Stock Market Investing Small Cap Stocks

The Proper Asset Allocation Of Stocks And Bonds By Age

Help Wanted Venture Capital Growth Company Help Wanted

/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

How To Achieve Optimal Asset Allocation

Team Genus Asset Allocation Financial Literacy Lessons Forex Trading Quotes Finance Investing

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

How To Achieve Optimal Asset Allocation

Internet Browser Market Share 1996 2019

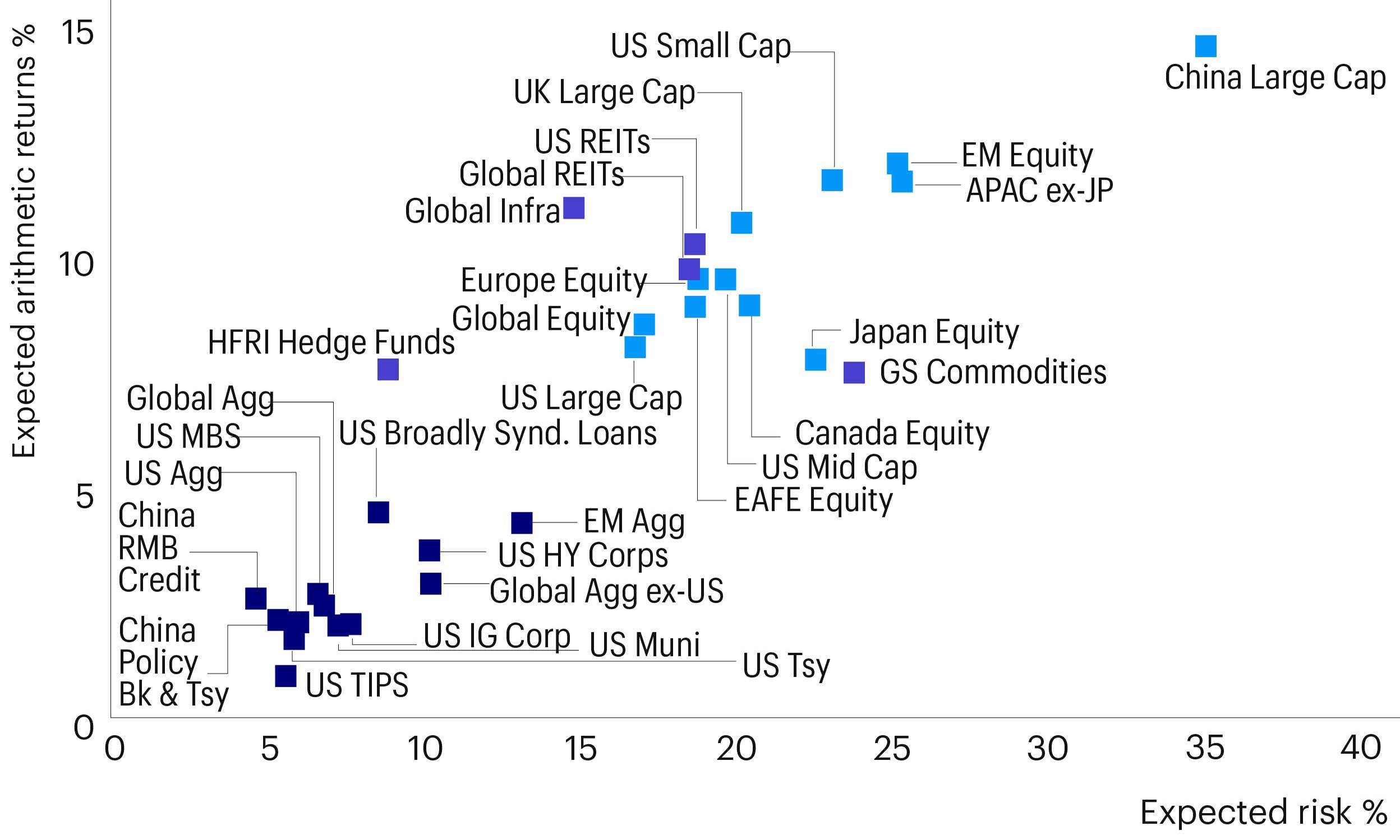

2022 Long Term Capital Market Assumptions

How To Achieve Optimal Asset Allocation Investing Personal Financial Planning Investment In India

:max_bytes(150000):strip_icc()/DeterminingRiskandtheRiskPyramid3-1cc4e411548c431aa97ac24bea046770.png)

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-02-0e9eaa2219934b4cb85c48fb9db7b45c.png)